- Tesla stock split history highlights rapid price growth underscored by the short amount of time it took in-between the splits.

- A look at Tesla’s historic price action before, during and after the stock splits.

- What the stock split means for investors.

It is now almost 14 years since Tesla INC. (NASDAQ: TSLA) went public and quite a lot happened within that time. Interestingly, Tesla stock split history only spans 3 years and it is quite noteworthy.

Before we dive in for a deeper understanding of Tesla stock split history, perhaps it would be best to first understand what stock splits are in the first place. By the end of this article you should have a good idea of what they are, why they occur and whether they are good or bad for investors.

What is a stock split?

Picture this, you run a company that has been doing quite well over the years and consequently, its share price is now well above the $1,000 mark. Tesla is one of the companies that have found themselves in this position.

A stock split allows a company to split one share into multiple shares. The total number of shares goes up by the split ratio, usually 3:1 or 4:1. This means 1 share is divided into three or 4 respectively. The total number of shares thus goes up by a factor of 3 or 4 but the value is divided by the corresponding ratio. This means the total value of the shares remains the same.

Let’s say you owned 1000 Tesla shares worth $1 million and a 4:1 Tesla stock split takes place. You will henceforth own 4,000 shares but their value will remain the same. However, the price of one share is split by 4. In this case, if the stock value was previously $1,000 per share, then the new post-split value will be $250.

About Tesla stock split history

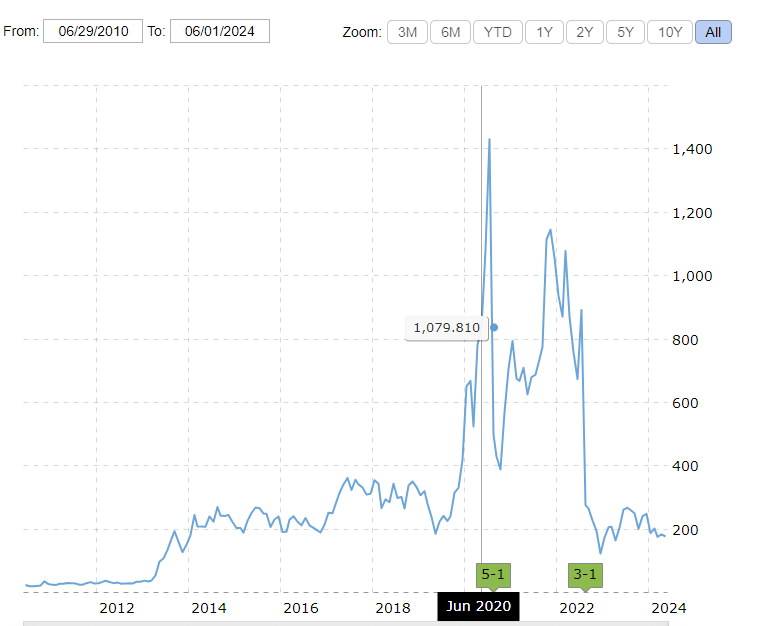

Tesla has conducted two stock splits in its history. The first one took place in August 2020 after an explosive rally fueled by heavy liquidity injection. Note that the stock had previously gone almost a decade before experiencing a stock split. So, why this particular period?

It turns out that 2020 was also the same year that Tesla stock soared above $1,000 for the first time, peaking at $1,430, after which a 5:1 stock split was conducted. The first stock split resulted in a sub $400 price per share. However, prices did not stay low for long as demand rapidly pushed back the price, resulting in another rally above the $1,000.

| Date | Split ratio | multiple |

| 25/08/2022 | 3:1 | X3 |

| 31/08/2020 | 5:1 | X5 |

The price peaked at $1,144 in November 2021. The stock price remained high, necessitating the second Tesla stock split in history, which came in August 2022. Here’s a chart demonstrating the historic price action including before and after the stock splits.

What does the Tesla stock split history mean for investors?

The first major implication of the Tesla stock split has to do with the same reason why many other companies have opted to go down the same route in the past. Investors might see a high stock price as a deterrent, hence many might choose not to buy when it has a high price tag. Those holding the stock might choose to cash out while the stock price is high.

Conclusion on Tesla stock split history

A stock split effectively enforces a psychological view that the stock is not overpriced. This is why companies such as Tesla usually conduct stock splits once their stock price becomes highly valued especially above $1,000 per share.

Tesla even confirmed during its last stock split announcement that the main reason for the split was to make the stock more accessible to investors. Meanwhile, the company is in a unique position to continue leveraging growth in the global market, hence the stock might have more upside in the coming years. If that happens, then there is potential for more stock splits in the future.

If you are curious about buying Tesla’s stock, check out Is Tesla A Good Stock To Buy Now?