PayPal USD (PYUSD) may not be the biggest stablecoin but it certainly fits the bill as far as one of the more noteworthy stablecoins. This is because it was launched by PayPal, a company that has earned a strong global presence as a global remittance company.

PYUSD had a bit of a rough start because a month after its August 2023 launch, the SEC kicked off an investigation of the stablecoin over regulatory concerns. PYUSD made its way on the spotlight recently after a recent PayPal filing revealed that the U.S-based regulatory watchdog got off PayPal’s back over PYUSD in February.

🚨BREAKING: The SEC has dropped its investigation into PayPal’s PYUSD stablecoin.

In a recent filing, PayPal said the SEC informed them in February that they are closing the inquiry “without enforcement action.”

— Coin Bureau (@coinbureau) April 30, 2025

The SEC’s conclusion of its PYUSD investigation suggests may pave the way for broader adoption of the stablecoin. The PayPal USD stablecoin was for a while, restricted to the Solana and Ethereum blockchains.

Will the PYUSD win against the SEC pave way for more adoption?

Despite the limited availability. The stablecoin still managed to soar to $1 billion just over 12 months after its launch. An indication that it was experiencing an aggressive pace of adoption.

However, PYUSD retreated lower than $500,000 by December 2024. It has since been recovering and recently pushed above $880 million.

Now that the SEC dropped its PYUSD inquiry, perhaps the stablecoin can smoothly expand to other networks. Such an outcome would allow it to spread its wings and achieve more adoption as a crypto on-ramp. This could accelerate PYUSD’s push past the $1 billion supply level.

BNB chain strengthens its bid for more stablecoin dominance

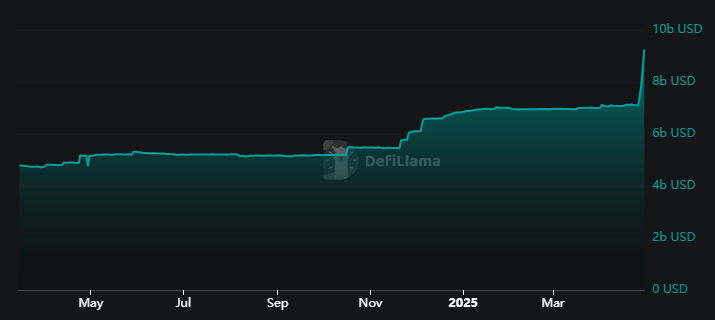

Still on stablecoins, BNB chain’s stablecoins marketcap has been growing gradually in the last 12 months. However, it registered a noteworthy spike this week.

BNB stablecoin marketcap jumped from $7.15 billion on 27 April to $9.26 billion on 30 April. A $2.11 billion difference in 3 days.

BNB chain remains one of the top blockchain networks and the surge in stablecoin count highlights its expanding liquidity expanding liquidity profile.

This recent spike was also in line with the ballooning global stablecoins marketcap observed recently. The total stablecoins marketcap has been ticking up gradually since October last year.

The total stablecoin count clocked $241.78 billion at press time. This was the highest historic peak after adding about $38.41 billion on a year-to-date basis.

Also check out: Monero (XMR) Gains Bullish Exposure After Massive Bitcoin Hack, Jumps To 3-Year High