In a shocking breach of security, Infini, a prominent stablecoin bank, has lost $49.5 million in a hack just days after the massive $1.46 billion attack on Bybit. The incident has raised alarm bells throughout the cryptocurrency community, as it underscores growing concerns over the security of decentralized finance (DeFi) platforms.

According to blockchain security experts, the Infini hack was the result of an insider exploit. A former developer who retained admin rights after the project’s completion reportedly used those privileges to drain the stablecoin bank’s funds. The hacker swiftly converted $49.5 million in USDC into 17,696 ETH, before transferring the stolen funds to an external wallet.

Christian Li, the founder of Infini, confirmed the breach and assured users that their ability to withdraw funds had not been affected. In a statement, Li took full responsibility for the attack, admitting that he had been negligent in transferring admin rights. He also vowed to compensate users fully, regardless of the outcome of the investigation. “This has sounded the alarm,” Li said. “We are committed to tracking down the hacker, and there is no issue with liquidity.”

It seems that the stablecoin bank @0xinfini was hacked and 49.5M $USDC was stolen.

The hacker swapped 49.5M $USDC for 49.5M $DAI and bought 17,696 $ETH.

The 17,696 $ETH was transferred to a new wallet “0xfcc8…6e49”.https://t.co/AdAyB3q5LA pic.twitter.com/Rft6ZDtDWO

— Lookonchain (@lookonchain) February 24, 2025

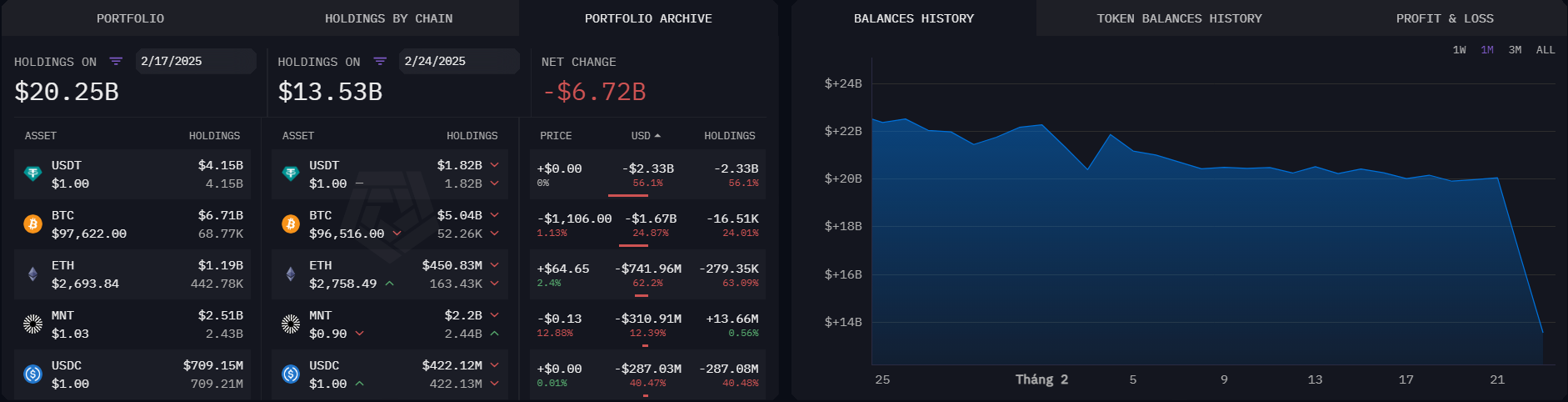

This attack comes on the heels of the Bybit hack, which prompted a wave of over $6.7 billion in withdrawals from the exchange. While Infini is working with authorities to investigate the breach, the incident adds to the growing anxiety surrounding DeFi platforms. Both hacks have prompted widespread calls for better security measures, particularly with the rise of insider threats and exploitation of platform vulnerabilities.

As the DeFi space continues to grow, experts are urging industry leaders to focus on improving safeguards to protect users and their assets. The debate over the future of decentralized exchanges and the need for more robust security measures remains at the forefront of crypto discussions.

Also read: SEC Drops Cases Against Coinbase, Binance, and OpenSea, Signaling Shift in Crypto Regulation