Binance’s latest Proof of Reserves (PoR) data shows a dramatic $8 billion drop in its non-customer assets, marking the lowest level in nearly two years. This significant decline has raised questions regarding the exchange’s asset management, with some speculating that the move could be linked to regulatory settlements, internal restructuring, or asset sales.

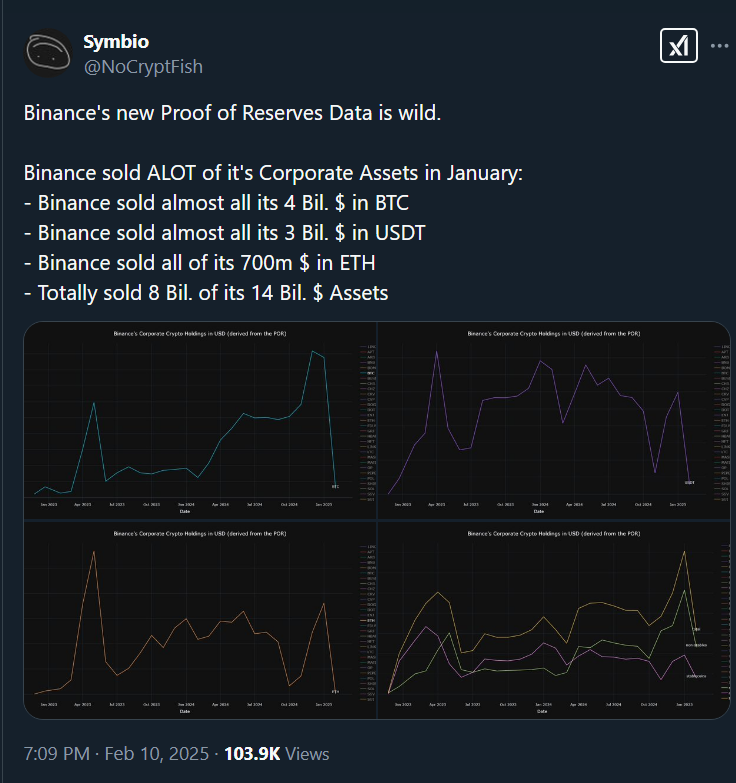

As of January 2025, Binance’s non-customer holdings, which represent the exchange’s assets, have decreased substantially compared to December 2024. The exchange’s reported reserves now include 2,746 Bitcoin (BTC), 275.7 million Tether (USDT), 174 Ethereum (ETH), 4.87 million BNB, and 4,179 Solana (SOL). These numbers are a sharp decline from the previous month, which showed Binance holding significantly larger quantities of assets.

This reduction has prompted speculation among industry insiders, with theories suggesting the decrease may be due to regulatory settlements or clawbacks related to the FTX collapse. Others believe Binance could have reallocated or sold assets for business expansion or investment purposes. However, Binance has yet to comment on the exact reasons for the decrease.

Despite the decline in non-customer assets, Binance maintains that it holds 100% of customer assets, backed by a 1:1 collateralization ratio. The exchange continues to face scrutiny over its financial transparency, especially following the fallout from FTX’s collapse in 2022.

As Bitcoin prices approach $97,659, the crypto community remains watchful of Binance’s next steps and the potential impact on market confidence.

Also read: Top 4 Affordable Cryptos to Buy and Potentially Become a Millionaire by 2025