Hedera Hashgraph’s native token, HBAR, has been stuck in a tight range since the start of February, reflecting a broader market consolidation. Trading between resistance at $0.24 and support at $0.22, HBAR shows signs of market indecision, with neither bulls nor bears able to assert control.

The asset’s flat movement, combined with weakening demand, places HBAR at risk of a downside breakout. A key indicator of this potential shift is the decline in open interest, which has plummeted by over 50% since February began, signaling reduced trader participation. At the time of writing, open interest stands at $182.96 million, reflecting waning investor confidence.

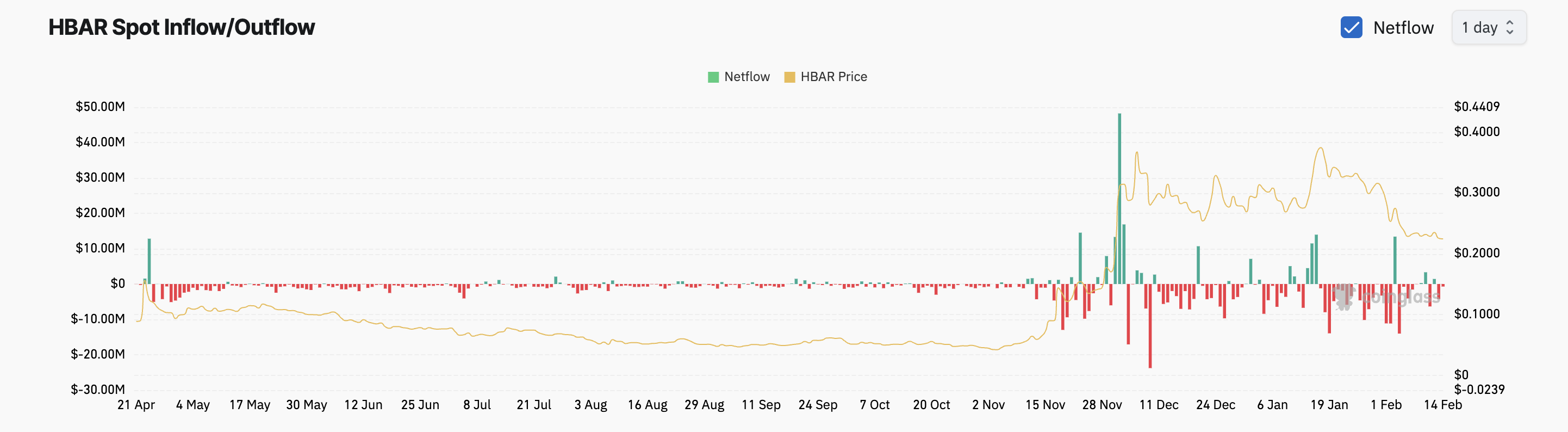

In addition to this, HBAR has experienced $43 million in spot market outflows over the past two weeks, with inflows only reaching $18.15 million. This selling pressure is compounded by a bearish Super Trend indicator, suggesting that if selling intensifies, HBAR could drop below the $0.22 support and even head toward $0.16.

While HBAR’s current resistance lies at $0.30, a significant breakout above the $0.24 mark could change the outlook and push prices higher. Without new demand entering the market, however, the risk remains tilted towards further declines in the short term.

Also read:Litecoin (LTC) Price Surge: Experts Predict a Breakthrough to $200 as Momentum Builds